Latest figures: AOL spent $225 for each member added

The sudden departure of America Online's COO and the

sharp

decrease in the firm's stock price coincides with insider selling by company employees of stock that, an analyst told Interactive Daily, may reflect underlying concern that Wall Street

had overvalued America Online's shares.

Interactive Daily

July 5, 1996

The penny in profits

Red Herring on Steve Case

AOL's estimated earnings for `96 are $38 million on estimated

revenues of $1 billion. But there's a catch. In the last couple of

years, AOL has made $100 million in acquisitions that some analysts feel

are languishing. Observers have also criticized the way AOL treats some

of the costs of attracting new members as capital expenses. They say that

AOL is more dependent than ever on attracting new members and retaining

old ones, a process that has become more costly.

According to

Cowen & Co., in the last quarter of 1995 AOL added 1.8 million new

members, but lost 950,000, leaving a net gain of 880,000. And despite the

May 8, 1996 release of slightly higher-than-expected 3Q earnings, AOL's

stock price fell 18% over a two-day period, in part due to comments by Mr.

Case about the need to improve "the retention of the customer base."

Cowen estimates that acquiring a new subscriber costs about $93.00 each.

Steve Case interview

Red

Herring: AOL has been criticized for engaging in "creative accounting"

for example, treating the costs associated with acquiring new subscribers

as capital expenses. What's your answer to this criticism?

Steve Case:Well, we've been doing this for 10 years, and we don't

think it's unusual at all.

(Red Herring magazine.

June, 1996)

A Letter from Interactive Week

If AOL logged a net gain of 1.7 million subscribers after spending

$200 million, it comes out to $117 for each subscriber added!

Apparently AOL bought their way to the #1 spot--with money they

didn't have! A few weeks back AOL released their third quarter

numbers. AOL accountants haven't expensed those marketing costs

against incoming revenue, and AOL has $276 million in

"deferred subscriber acquisition costs".

Because of this it's been said that AOL

pays their bills through stock sales. But AOL stock lost

27.3% of its value between May 7 and May 22...

And now they're

cutting prices on the service.

Maybe the aggressive overseas expansion is intended to

prop up the pyramid...

Something funny's going on here...

"AOL takes it on the chin" wrote Interactive Week in a previous issue. Gradually industry insiders are recognizing that AOL's finances are in a precarious position.

As early as 1994, Steve Case was naming 5 million members as AOL's "critical mass", with the hope that advertising revenues could generate income for the company. AOL now flashes advertisements to every member logging on to the system. (Sometimes, at the expense of user privacy.)

AOL acts nonchalant. They claimed a profit in their quarterly statement--suspiciously coming within analyst projections by exactly one cent. Then they announced that they intended to reduce marketing spending, which might cut into their profitability.

But the subscriber growth rate was already decreasing. Furthermore, competition from AT&T, the Microsoft Network, and internet service providers around the country forced AOL to lower their prices--starting in July, 20 hours on the service will on

ly net AOL $20.00. And in the last 3 months they took in just $13 million in advertising revenue --

vs. $285 million in online service revenue.

Which wouldn't threaten AOL--except that they have over $300 million in deferred costs spent to reach the 5 million subscriber mark. "If AOL can't sell stock, its got big trouble," Allan Sloan wrote in Newsweek. In the May 27 issue of Newsweek, S

loan revists AOL. "In an interview last month, Case claimed not to be worried," he writes. He calculates AOL has spent $315 million which has not yet been covered by their profits!

"The turnover is spooking Wall Street," Sloan writes.

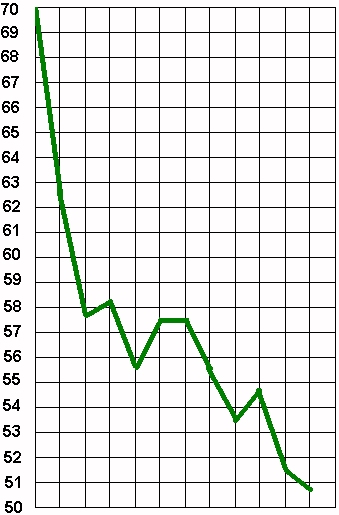

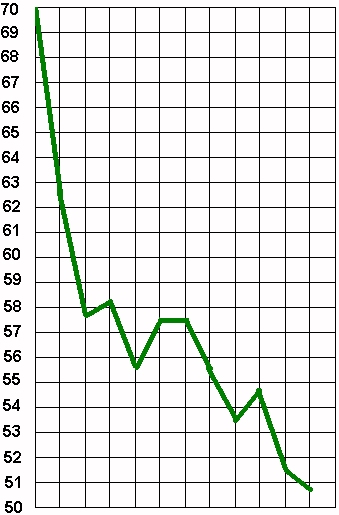

At the bottom of this page is a graph illustrating the dramatic drop in the value of AOL's stock. Between May 7 and June 20, AOL stock lost 43.57% of its value.

Bad press reports continued...

AMERICA ONLINE STOCK continued its slide on Friday when Merrill Lynch analyst Lou Kerner lowered his earnings estimate for AMER from $1.15 to

$1.00 for the year ending June 1997. According to reports, Kerner lowered his estimate based on impact of the recently announced $20/20 hour plan which will

be available effective July 1. Kerner said that he estimated the impact of the new pricing plan to be about a 9%-10% reduction in AOL's average revenue per

subscriber.

From Seidman's Online Insider

By May 22, AOL stock had lost 26.5% of its value in a two-week period.

Here's the smoking gun. From AOL's Third Quarter financial statement:

As a result of the combination of less aggressive acquisition marketing spending and higher subscriber attrition, which the Company believes is related primarily to the number of subscribers acquired in the most recent two quarters, the growth

in subscribers is expected to slow through the first quarter of fiscal 1997.

"Higher subscriber attrition".

The magic words...

In May, Robert Seidman wrote...

Growth may be slowing down. On December 28, 1995, AOL

announced it had surpassed the 4.5 million member mark. About 40 days

later, on February 6, AOL announced it had eclipsed 5 million. Since

then, we've heard nothing, but I believe we'll hear shortly that they've

eclipsed the 6 million member mark.

A week later, still nothing...

The thing is AOL was growing at a run

rate of about 1 million every 80 days. By that logic, if AOL was still

growing at that pace, they'd have announced the 6 million mark on about

April 26. I expect we'll see this announcement sometime in the next 2

weeks...

But there was no announcement. (Quotes taken from Seidman's Online Insider.) It was later revealed that AOL was only able to announce they'd reached 6 million subscribers by inflating the count with their GNN subscribers. Though they use that figure in every press release, AOL has yet to reach 6 million members!

Referring to AOL's previous quarter, Interactive Week wrote:

AOL added 905,000 customers to its service during the most recent

quarter, bringing its total to 5.5 million subscribers...

Robert Seidman reported...

On December 28, 1995, AOL announced it had surpassed the 4.5 million

member mark. About 40 days later, on February 6, AOL announced it

had eclipsed 5 million.

The quarter Interactive Week referred to ended March 31.

December 28 - February 6 500,000 members in 40 days

February 6 - March 31 500,000 members in 52 days

The growth rate dropped by 23%

But it gets worse...

March 31 - June 30 Less than 500,000 members in 90 days

In a May 22 press release AOL was still announcing "more than 5.5 million members".

Note: this was *before* they began "putting the brakes" on growth--the pre-emptive euphemism AOL used announcing their third-quarter earnings. This drop in the growth rate is AOL's worst ni

ghtmare. Forbes wrote in

October (10/23/95) that AOL borrows against future earnings. In

"Subscribers Today, Cost Manana," they wrote "there's no harm done so long

as the number of loyal subscribers continues to climb. But watch out if

competition from Microsoft and others accelerates the turnover on America

Online's subscriber list. What happens if new subscribers last, on

average, less than 24 months? Then America Online would have to write

down the paper asset it calls 'deferred subscriber acquisition costs.'

That item appeared on the last published balance sheet as $77 million, a

big number in comparison to the company's $17 million in net income for

the fiscal year ended June 30, excluding a one-time acquisition charge."

On April 15, Business Week reported, "Case is running a high-wire act."

The whole setup depends on continuing rapid growth: A slowdown in

subscriber sign-ups, a price war that drives down per-subscriber revenue

or, worst of all, a loss of subscribers could spell real trouble...

The article goes on to point out that AOL has spent $93.00 per head acquiring new

subscribers--and the deficit has more than doubled, to $189 million.

That adds up to a huge gamble... If growth slows, those deferred

costs could erase future earnings.

AOL's latest figures show the deferred subscriber acquisition costs have since ballooned to $276 million!

Allan Sloan wrote in Newsweek (10/23/95) that AOL was "covering its cash

deficit with money from stock sales", raising $100 million dollars in a

stock offering they were too desperate to delay, even though the market

was down. "If AOL can't sell stock, it's got big trouble," Sloan

wrote, saying AOL "needs to sell stock periodically to meet its bills."

There's more. "AOL is as much about accounting technology as it is about

computer technology," Sloan pointed out. He noted that due to an especially creative

accounting decision "AOL's profits would have been $62 million lower had

it charged off these expenses as incurred, rather than treating them as

capital items."

On the $100 million in stock sales, Sloan notes that some analysts feel

AOL "really needed the money, if only because its trade accounts payable

had ballooned to $85 million as of June 30".

Investors must be terrified by AOL's new discount in pricing. When AOL announced their value plan, they even *delayed* implentation of it for an extra month--until July--to rake in one last month of the high-pricing revenues. To hide the announcement,

they bundled it with announcements of quarterly profits and overseas expansions--though in fact it's standard practice for companies to try to

expand overseas when the domestic markets are too competitive.

AOL stock dropped 17.6% in the two days after the announcement as worried investors saw the company's profitability threatened. In the 10 days after May 7, AOL stock lost more than 23% of its value.

What makes the announcement so remarkable is that the week before the announcement, Steve Case told Robert Seidman:

"We've done a lot of price testing -- of lower and higher monthly fees,

with varying amounts of free time -- and there's a reason why we're still

at $9.95 for 5 hours. If we thought we could attract more customers

with a different price point, we'd do it...

Backpedalling furiously, AOL's spokeswoman Pam McGraw downplayed the switch in policy, telling C|Net that 95% of AOL's users spend less than 5 hours per month online.

But if that's true, then to get the average bill of $18.00 a

month reported in Business Week, the paltry 5% who do go over $9.95 a

month must be racking up monthly bills of $153.00--and using the service for 48 hours a month.

Under a $20-for-20-hours plan, that would still come out to $104.00. AOL only gives

a discount on the middle 15 hours, which now goes for $10.00 instead of

$45.00.

Still, even if Pam McGraw's figures are correct, AOL gives up close to $100 million a year from that 5% of their customers.

AOL's stock lost

27.3% of its value

between

May 7 and May 22.

Return to Main page